HOW TO MAKE A GIFT

Cash, Check, or Credit Card*

To make a gift of cash, please visit the Virginia Athletics Foundation (VAF) office located in Bryant Hall at 1815 Stadium Road, Charlottesville, Va. 22903.

To make a gift by credit card over the phone (Visa, Mastercard, American Express, and Discover accepted), please call the VAF office at 800.626.8723 or 434.982.5555.

To make a gift or pledge by check or credit card, please download and print the pledge form below. Checks should be made payable to Virginia Athletics Foundation and mailed to:

Virginia Athletics Foundation

P. O. Box 400833

Charlottesville, VA 22904-4833

*Please do not email credit card information to the VAF.

Online

If you have ever made a gift to the VAF, select the VAF Member button. If this is your first gift, select New VAF Member.

If you are unsure of which option to use, please call the VAF at 800.626.8723.

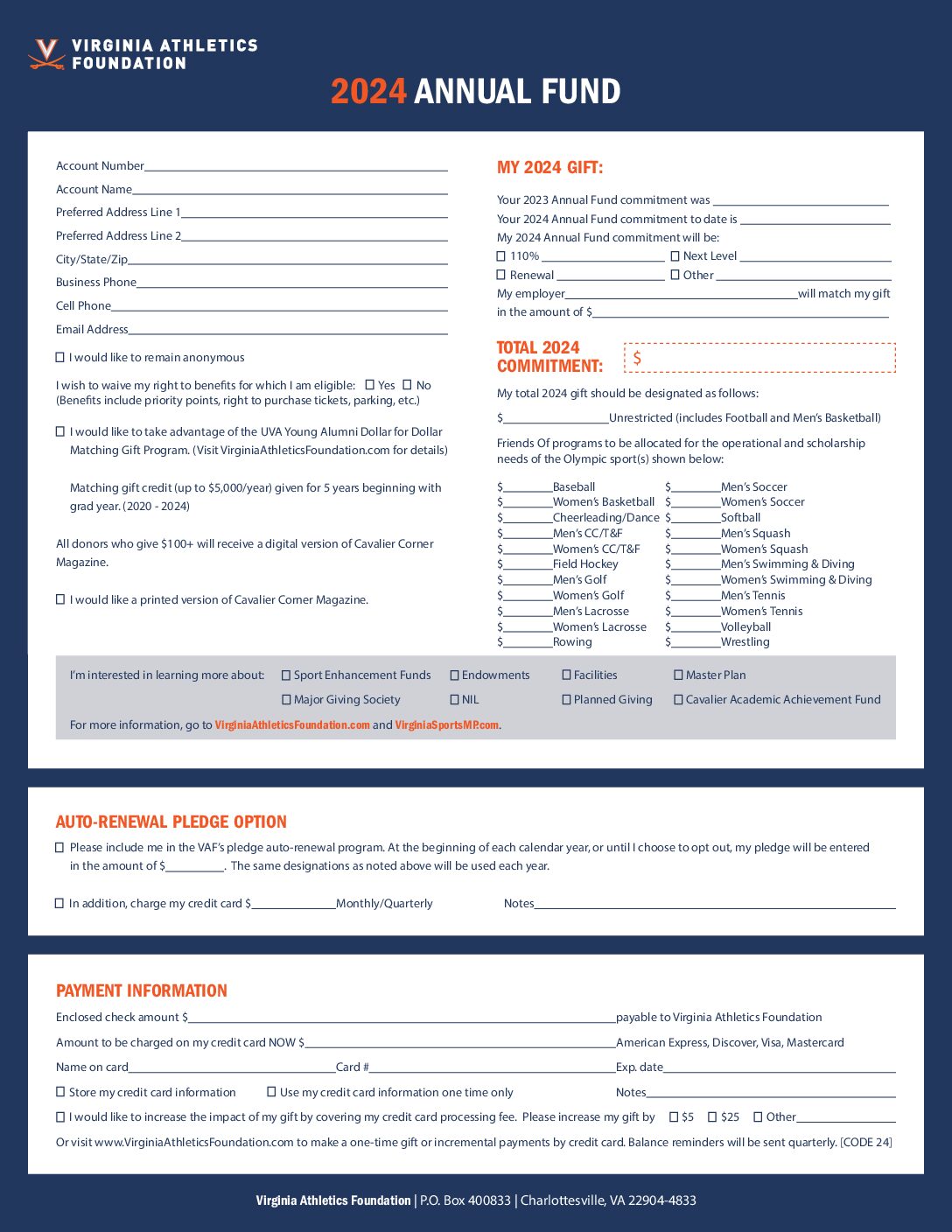

Pledge Form

Download the pledge form shown below. After completing the form, please mail to the VAF office.

Stock

Giving stock through electronic transfer is the easiest method when a donor maintains holdings in a brokered account. Depository Trust Company, or DTC, is the clearinghouse for electronic security transfers. Each brokerage firm has a specific DTC number.

Giving stock through electronic transfer is the easiest method when a donor maintains holdings in a brokered account. Depository Trust Company, or DTC, is the clearinghouse for electronic security transfers. Each brokerage firm has a specific DTC number.

Please contact the VAF office to alert our gift accounting office of the transfer. Be sure to include the donor’s name and gift designation.

800.626.8723 | 434.982.5555

Stock Gift Instructions

Davenport & Company LLC

DTC #0443 (Pershing)

Account # DA4005116

Account name: Virginia Athletics Foundation

Contact person at Davenport – Marie Barté – 804-780-2000 <mbarte@investdavenport.com

ACH or Wire Instructions

Please contact the VAF office at 434-982-5555 for instructions.

Donor-Advised Funds (DAF)

or payments from Private, Charitable, or Family Foundations

The VAF can only accept payments from donor-advised funds or private, charitable, or family foundations that would be permitted by the IRS. The IRS only permits gifts from these giving vehicles that would otherwise be fully deductible for income tax purposes.

IRS regulations prohibit the VAF from accepting gifts from DAFs and Charitable Foundations if they are associated with benefits including the right to purchase tickets to home games.

Cryptocurrency

Gifts of cryptocurrency valued at $5,000 or more can be processed through the UVA Foundation. Please e-mail UAS@virginia.edu or contact the VAF at 800.626.8723 for more details.

IRA or Qualified Charitable Distribution (QCD)

The VAF is qualified to accept charitable IRA rollovers from donors aged 70½ or older with qualifying IRAs. Additionally, the donor cannot receive benefits for this type of gift.

If you are sending payment directly from your IRA, according to IRS regulations, the payment must be a deductible gift in order to be eligible for QCD treatment.

Gifts where the donor receives a benefit in return, including gifts that give the donor the right to purchase tickets to home games at the University of Virginia, are not deductible per IRS Regulations Code Section 170(l). The VAF recommends that you consult your tax advisor.

To initiate, please contact your IRA administrator.

Employer Matching Gifts

How to Make a Matching Gift:

- Ask your company’s human resource representative if they will match gifts to athletics-related organizations and what percentage of your gift they will match.

- Obtain the matching gift application form or the matching gift website used by your company to apply for a matching gift.

- Complete your portion of the matching gift application form and send it to the Virginia Athletics Foundation, P.O. Box 400833, Charlottesville, VA 22904 with your VAF pledge form and/or gift. Or, go to your employer’s matching gift website and complete the application online.

- Gifts will be verified to the matching company by the Virginia Athletics Foundation as soon as the matching gift application is submitted and the pledge is paid in full.

Make Your Gift Go Farther

You may be able to increase the capacity of your gift. Please check to see if your employer will match your athletics-related gift.

The VAF is not able to return gifts to donors as these monies are transferred to the athletics department on a regular basis throughout the year to cover expenses including scholarship costs, academic affairs, operational needs, and facilities projects.

Charitable Status: The Virginia Athletics Foundation is a 501(c)(3) charitable organization with more than 9,500 members. The VAF qualifies for the charitable contribution deduction under Section 170(b)(1)(A) and has been classified as an organization that is not a private foundation under Section 509(a)(1). Member’s contributions support the costs of athletic scholarships, the Athletics Academic Affairs Office, sport-specific operational needs, and facility upgrades.

VAF FEIN 54-0517188 – Virginia Student Aid Foundation (DBA Virginia Athletics Foundation)