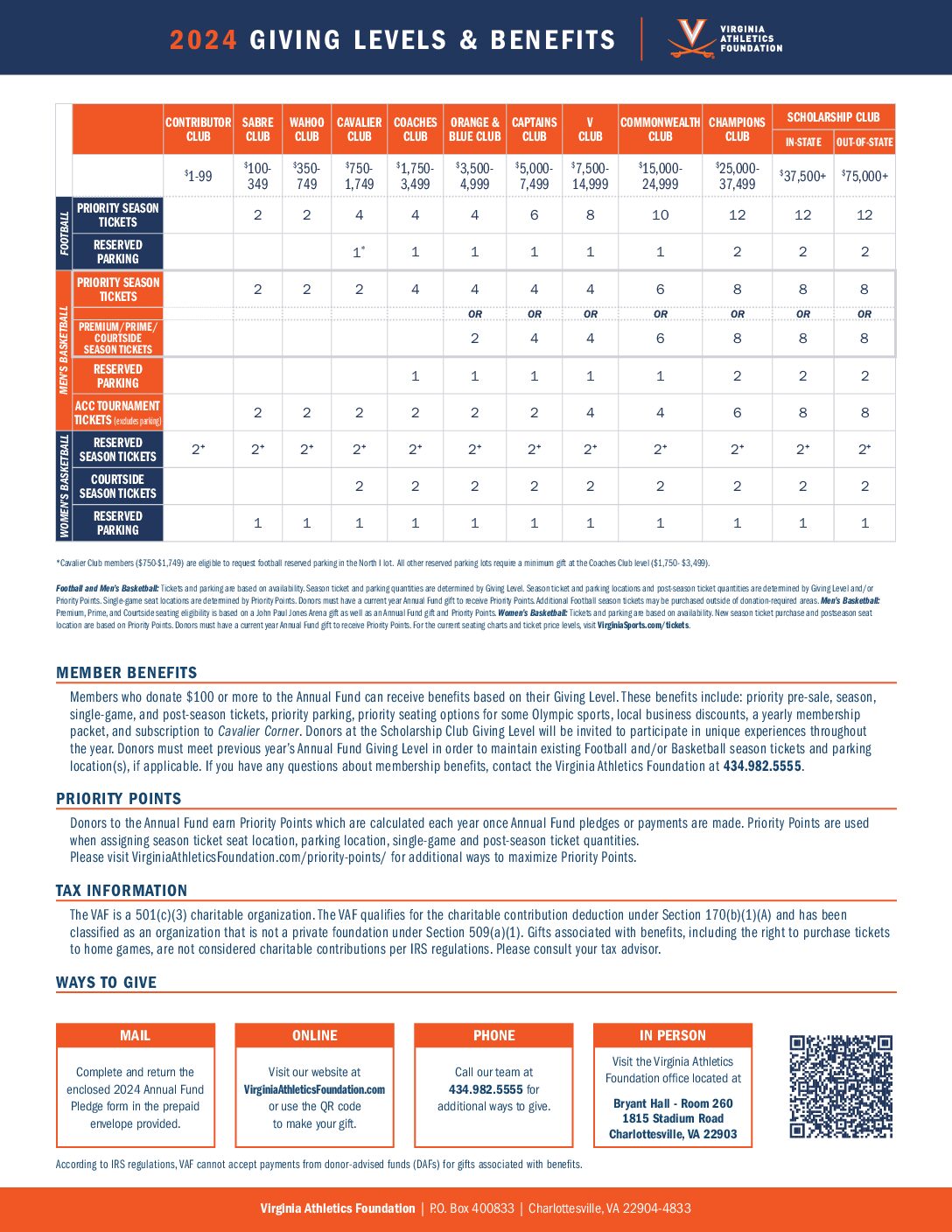

A member’s annual giving level determines the number, and in some cases the location, of priority and premium seating and parking options available. The Virginia Athletics Foundation (VAF) benefits chart outlines by giving level the number and location of benefits associated with each level.

Newly Announced 2024 Scholarship Society Giving Level:

In-State: $37,500

Out-of-State: $75,000

Football and Men’s Basketball:Tickets and parking are based on availability. Season ticket and parking pass quantities are determined by VAF Giving Level. Season ticket and parking locations and post-season ticket quantities are determined by Giving Level and/or Priority Points. Single-game seat locations are determined by Priority Points. Donors must have a current year Annual Fund gift to receive Priority Points. Additional Football and Men’s Basketball season tickets may be purchased outside of donation-required areas. Men’s Basketball: Premium and Prime seating eligibility is based on a John Paul Jones Arena gift as well as an Annual Fund gift and Priority Points. For the current seating charts and ticket price levels, visit VirginiaSports.com/tickets.

NOTE: Donors also have access to ticket presales, as well as priority seating options for some Olympic sports, as they apply. If you have any questions about membership benefits, contact the Virginia Athletics Foundation at 434.982.5555 or 800.626.8723.

The VAF is a 501(c)(3) charitable organization. The VAF qualifies for the charitable contribution deduction under Section 170(b)(1)(A) and has been classified as an organization that is not a private foundation under Section 509(a)(1). Gifts associated with benefits, including the right to purchase tickets to home games, are not considered charitable contributions per IRS regulations. Please consult your tax advisor.

A note on tax deductibility: Per IRS Regulations, gifts associated with the right to purchase tickets to home games are not deductible. Please reference the above chart to determine the portion of your Annual Fund gift that may not be tax deductible. The Foundation further suggests that donors consult a tax professional.